Fintech Software Development

Embrace digital transformation of your financial services with fintech software development by Apiko. We bring in our deep expertise to provide a full-scale financial software development process that is specifically tailored to your business needs. Achieve improved operational efficiency, greater transparency, and better user experience with a custom and reliable tech solution.What can Apiko do for you?

Our fintech software development services include:

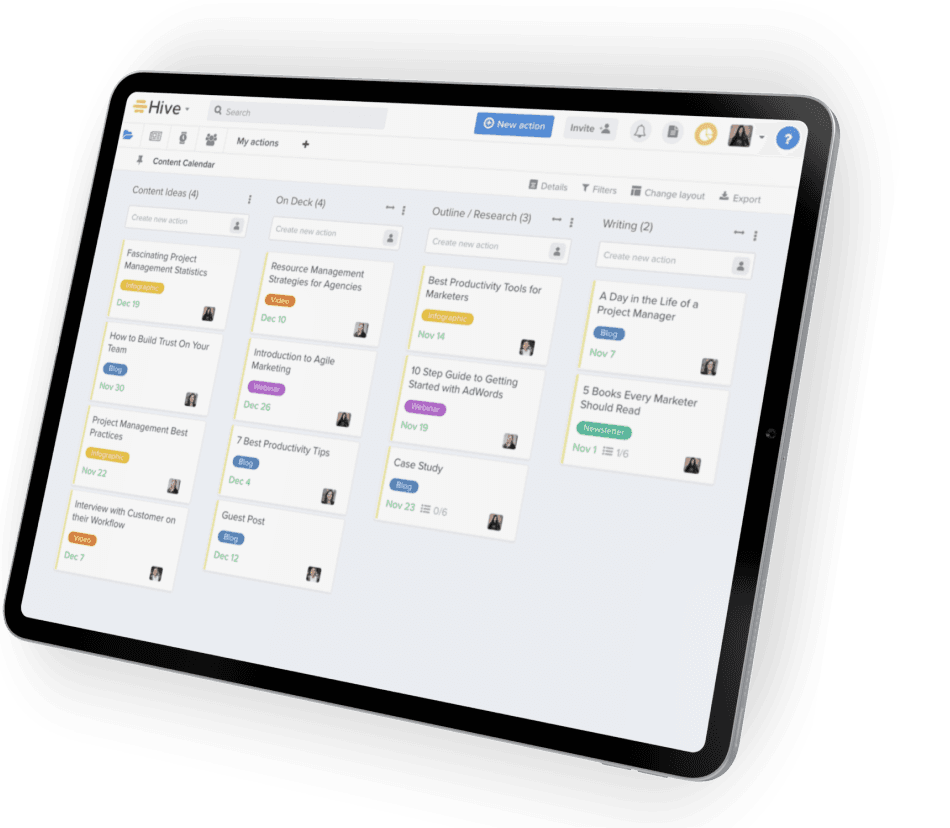

Our financial software development process

Having years of experience delivering top-notch digital solutions to businesses all over the world, Apiko have acquired extensive expertise. We cover all aspects needed for efficient software development, from project management, UI/UX design, web/mobile development, to delivery and maintenance.

Business analysis & requirements elicitation

Apiko is all about predictable software engineering. Before we start a project, our expert team of Business Analysts and Project Managers will closely examine your product idea, create a comprehensive WBS (Work Breakdown Structure) and present you with a ballpark estimate of the project.UI/UX design

Once we have gathered the requirements, Apiko UI/UX designer and Business Analyst work together to create a visual representation of your idea. We develop your product’s wireframes, clickable prototypes, and UI/UX design to gather early feedback. At this stage, Project Manager together with the Tech Lead also determine the required technology stack to bring about a reliable product within your budget.Technical development and testing

When the concept of your idea is ready, the prototype is created, and the technology stack is chosen, Apiko team can move straight on to the software development process. We hold daily scrum meetings and morning reports to make sure everyone is on the same page. Throughout the whole development process, Apiko QA team enforces effective quality control of your fintech software product. Automated and manual testing throughout each development stage guarantees your platform’s smooth and high-quality functioning.Platform support

Apiko tech engineers are not only responsible for the delivery and deployment of your software, but also for the assistance and support even after the solution’s launch. We aim for continuous partnerships and provide product lifecycle support, further integrations and improvements on a long-term basis.Why employ financial software development services?

With the financial world experiencing rapid growth, integrating modern tools and technologies is the best way to stay competitive and reach the desired efficiency. High-quality fintech software delivers advanced tools to help you automate and simplify repetitive tasks, analyze large data volumes, and ensure security.

Business-centric financial solutions

Employing custom financial software development services allows companies to build different business-centric solutions with unique functionality and UI/UX design. You can opt for fintech tools like billing systems for automated invoicing, accounting software for cash-flow control, mobile banking, and much more.

Data visualization & analytics

Building fintech software allows you to visualize essential data to make it more transparent and prominent. Such solutions foster comprehensive analytics, simplify metrics tracking, and enable strategic decision-making.

Keeping your data secure

For every company, data security is a number one priority. Financial software can make sure your business data is protected. Powered with compliances, tokenization, blockchain and data encryption, you can design financial tools that will secure all types of data, from individual messages to databases.

Finance process automation

Fintech software automates key finance-related operations such as accounting, payments optimization, back-office operations with minimal human intervention. The financial tools enable businesses to streamline their processes and make sure that everything runs as smoothly as possible.

Fintech software types

From simple mobile payment apps to complex financial platforms for enterprises, Apiko can provide you with our in-depth software development expertise and top talent to create an effective fintech solution your business needs.

InsurTech

Insurance technology is one of the fastest growing sectors of the financial software market that is expected to reach $1.19 billion by 2027. InsurTech makes it easier for customers to get and manage their insurances, and for companies to streamline their operations as well as the quality of the services.

Key features:

- Data storage

- Document management

- Billing and invoicing to monitor transactions and issue receipts

- Reports

Payment gateways

Payment gateways are widely used by eCommerce websites allowing customers to perform financial transactions paying for their orders with the help of debit or credit cards. Some of the popular payment gateways are MasterPass, LiqPay, and PayPal.

Key features:

- Secure payment processing of different credit and debit cards

- Payment analytics and reporting

- Multi-currency international payments

- Customer information storage for instant payments

- Third-party integrations

Lending apps

Lending apps make it possible for users to borrow from other people on a virtual peer-to-peer marketplace. Platforms like these usually focus on reducing operational costs to make more attractive terms for investors than ordinary banks. The global P2P lending market is expected to achieve $558.91 billion by 2027.

Key features:

- Loan calculator to determine monthly loan payments

- Database of users’ credit stories

- Loan application and user verification

- Payment schedule and billing

- Financial transactions such as money transfers and withdrawals

Mobile payments and eWallets

Global mobile payment market is expected to reach $12.06 Trillion by 2027. Mobile payment services allow customers to transfer money in an instant, ensuring the security and seamlessness of transactions cash-free.

Key features:

- Contactless payments with NFC readers and QR code scanners

- Security like TLS encryption, firewall, multi-factor authentication

- Instant money transfers between mobile wallets, bank accounts, or virtual cards

- Bill payments

- Push notifications

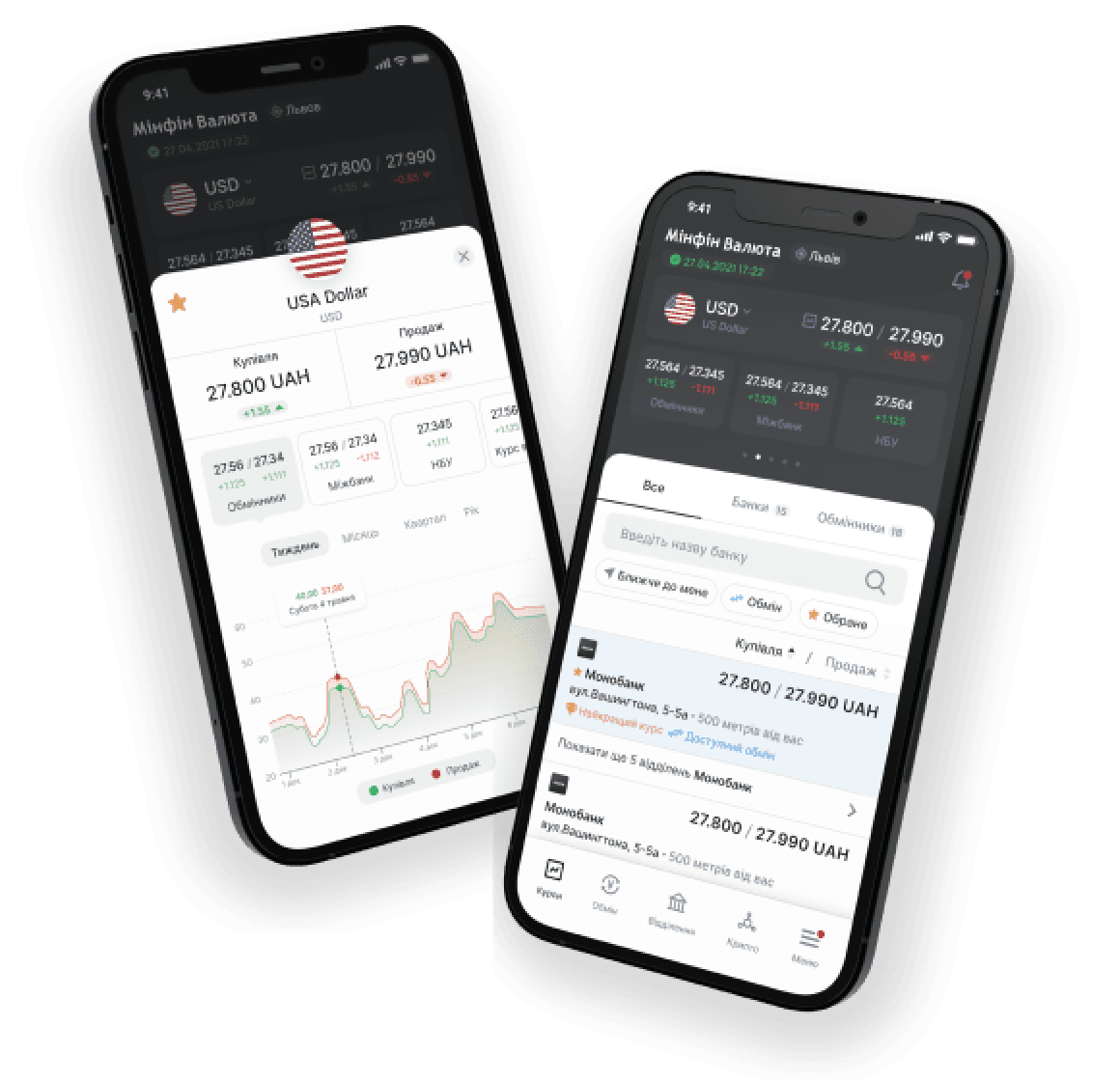

Mobile banking

Mobile banking apps are quickly becoming way more popular than traditional institutions in providing easy-to-access banking services. Such solutions enrich the experience of the bank customers, free the bank’s support team, and allow users to manage their accounts and money at any time from anywhere.

Key features:

- Secure authentication

- Chatbots and customer support

- Account management functionality such as balance check, funds transfer

- An integrated map to locate ATMs

- QR code payments

- Push notifications

Tax management

Tax management is a complex though an integral procedure for businesses. To help automate this process, employing tax management software can be extremely useful. You can build a solution that helps users fill in their tax forms using pre-developed templates, track their expenditure and earnings, calculate the amount of taxes needed to pay, gather reports, etc.

Key features:

- Payment gateway to enable financial transactions

- Templates of tax management documents

- Tax calculator

- Reports and analysis

Accounting systems

Every business has to deal with money transactions and, to do it effectively, accounting systems and bookkeeping applications are a must. Fintech solutions, such as payroll software, billing and invoicing software, Enterprise Resource Planning (ERP) systems, are used by organizations to keep track of their expenses and revenues in one place.

Key features:

- Basic accounting functionality such as chart of accounts, invoicing, and financial reports

- Payroll and time tracking

- Expense tracking

- Asset management

- Reporting and analysis

Personal finance apps

Tracking one’s expenses is vital for preventing inefficient budgeting and impulsive spending. Personal finance apps enable users to keep a record of their finances seamlessly, without the need to dig through piles of receipts. Because money management apps deliver considerable value to users, they are in great demand, expected to reach $1,58 billion by 2027, and a good opportunity for investment.

Key features:

- Data visualization with an analytical dashboard

- Personalization

- Security and standards compliance

- Integration with different banks and payment systems

- Tracking bills and expenses

- Multi-factor authentication

- Notifications and alerts

- Help and support

Fintech software case studies

Questions you may have

Learn more about our flow

Financial technology helps organizations take care of their financial functions with the support of advanced tools and features. The fintech software market is rapidly growing and is expected to reach a value of USD 25.48 billion, at a CAGR of 8.97% during 2021-2025.

Organizations, which choose to outsource their fintech project development can benefit from the process significantly in the following ways:

By outsourcing, companies can gain access to new talents and their extensive expertise cost-effectively

Take advantage of structured and well-organized IT processes based on proven practices.

Get exceptional quality at a lower cost.

Free the in-house team to focus on core business processes.

The fintech industry is undergoing rapid development. Whatever sector you choose, having an idea that solves your customers’ pain points, a reliable software development team and the right technology are the things that matter the most. Study your niche and potential customers, outline the functionality that may be helpful to them and choose a software agency that will bring it all to life. If you have any questions about fintech software development or need a team for your product’s implementation, you can fill the contact form and get a free consultation from Apiko.

Main technologies we use for fintech software development

By utilizing a number of frontend, backend, DevOps, infrastructure and database technologies, Apiko delivers comprehensive and competitive fintech solutions customized precisely to meet our clients’ exact requirements.